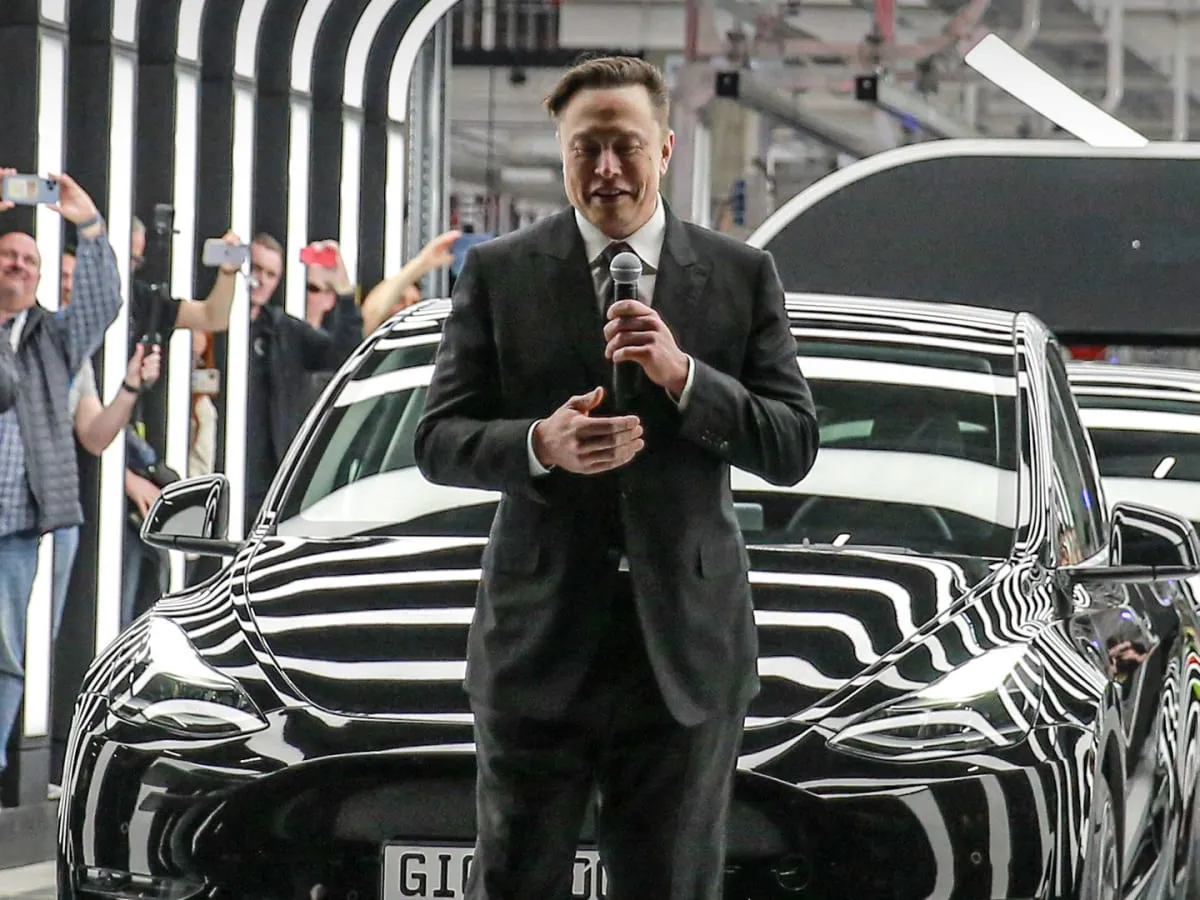

Elon Musk Spends Billions on Tesla Shares, Reinforcing Vision to Dominate the Self-Driving Era

When Elon Musk makes a move, the world watches. Over the years, the Tesla CEO has built a reputation not only as a visionary but also as someone unafraid of bold, risky bets that could alter the future of technology and business. His latest move, spending billions of dollars to buy more Tesla shares, has sparked massive debate on Wall Street, in Silicon Valley, and among global investors. To some, it is a sign of confidence, proof that Musk is doubling down on his long-term belief in the company. To others, it is a dangerous gamble in a volatile market. But one thing is certain: Musk’s move underscores his unshakable vision of making Tesla the dominant force in the self-driving era.

A Billion-Dollar Vote of Confidence

Musk’s purchase of Tesla stock comes at a time when the company has faced both remarkable growth and unprecedented challenges. With increased competition from rivals such as BYD in China, Ford and General Motors in the United States, and legacy European automakers like Volkswagen, the electric vehicle space has become crowded. Yet, Musk’s decision to invest billions of his personal fortune into Tesla shares suggests that he sees the company not merely as an automaker but as a technology powerhouse poised to lead the next generation of innovation. Analysts describe this move as a “vote of confidence” not just in Tesla’s immediate financial future but in the broader technological revolution it is spearheading.

Tesla’s stock price has often been described as reflecting the “Musk premium.” Investors trust that the eccentric billionaire’s ability to disrupt industries will create future value that goes beyond traditional measures like earnings per share. By pouring billions back into Tesla, Musk is signaling that his confidence in the company’s trajectory has never been stronger.

Beyond Cars: A Tech Giant in Disguise

One of the most important things to understand about Musk’s strategy is that Tesla is not just a car company. While it produces some of the most advanced and popular electric vehicles in the world, Tesla’s long-term business model hinges on technologies that extend far beyond cars. Musk has repeatedly emphasized that Tesla is, at its core, a software and artificial intelligence company. The future of Tesla, in his words, lies in autonomous driving.

Musk envisions a world where Tesla vehicles, powered by Full Self-Driving (FSD) technology, operate as autonomous taxis, generating income for owners and creating a decentralized, robotic transportation network. In this future, Tesla is not only competing with automakers but also with Uber, Lyft, airlines, and public transportation systems. Buying billions of dollars in stock now demonstrates Musk’s commitment to realizing this audacious plan.

Betting Big on Self-Driving

The self-driving industry is one of the most competitive and controversial technological frontiers today. Companies such as Waymo, Cruise, and Apple have all attempted to crack the code of creating fully autonomous cars. Many have failed or scaled back their ambitions. But Musk remains adamant that Tesla will succeed where others have faltered.

Tesla’s self-driving technology is unique in its approach. Instead of relying heavily on lidar sensors, as most competitors do, Tesla uses vision-based systems powered by AI. Musk insists this mimics human perception more closely, and Tesla’s massive fleet of customer-owned vehicles provides constant streams of driving data to train its algorithms. With millions of cars on the road feeding real-world data back into the system, Tesla has a data advantage that no competitor can match.

Musk’s stock purchase can therefore be seen as a direct bet on the near-future breakthrough of Tesla’s self-driving technology. Should the company achieve full autonomy before its rivals, Tesla’s valuation could skyrocket, turning today’s investment into tomorrow’s fortune.

Managing Investor Confidence

While many celebrate Musk’s billion-dollar buy, others warn of potential risks. Tesla’s stock has been volatile in recent years, soaring to astronomical highs before crashing back down during market corrections. Critics argue that the company’s valuation is still out of proportion compared to traditional automakers, especially given that Tesla’s profits largely come from car sales rather than from futuristic services like robotaxis.

Yet Musk seems unbothered by short-term fluctuations. His investment sends a clear message: Tesla is not about quarterly earnings but about long-term dominance. By purchasing shares during periods of uncertainty, Musk is reinforcing investor confidence and signaling that Tesla is built to weather storms.

Musk’s Legacy Tied to Tesla

It’s impossible to separate Elon Musk’s personal identity from Tesla. While he has founded and led other groundbreaking companies such as SpaceX, Neuralink, and The Boring Company, Tesla remains his most public-facing endeavor. The company is both a symbol of his success and a canvas for his vision of the future.

Critics often highlight Musk’s controversial behavior, from his late-night social media posts to his clashes with regulators. But for supporters, these moments pale in comparison to his role as a pioneer of electric mobility and clean energy. Buying billions of dollars in Tesla shares reinforces that Musk is not just Tesla’s CEO — he is its biggest believer.

Global Competition and Market Pressure

Tesla’s dominance is far from guaranteed. Chinese automaker BYD recently surpassed Tesla in global EV sales, highlighting the intensity of competition in the electric vehicle space. European automakers are pushing aggressively into electrification, while U.S. rivals like Ford and GM are launching new EV models every year.

Moreover, geopolitical challenges such as tariffs, supply chain disruptions, and rare earth material shortages pose additional risks. Yet, Musk’s confidence signals that Tesla has both the technological edge and the brand power to withstand competition. For him, the self-driving future is not a question of if, but when.

The Bigger Picture: AI and Energy

While much of the media focus is on Tesla cars, Musk has consistently reminded the world that Tesla’s mission is broader: to accelerate the world’s transition to sustainable energy. Beyond vehicles, Tesla is a leader in battery storage solutions and solar energy systems. These technologies will play a critical role in addressing climate change and reshaping the global energy landscape.

At the same time, Musk has made it clear that Tesla is also an AI company. Its breakthroughs in machine learning and real-time decision-making for autonomous vehicles could be applied in other industries, creating opportunities far beyond transportation. Musk’s stock purchase, therefore, is not just about cars — it’s about investing in Tesla as a hub of innovation across energy, AI, and robotics.

A Personal Gamble

Elon Musk is the world’s richest man, but that doesn’t make his billion-dollar stock purchases trivial. By putting so much of his wealth into Tesla, Musk is tying his financial future even more closely to the company’s success. For most CEOs, this level of personal investment would be considered reckless. For Musk, it’s consistent with his history of going “all in” on ventures he believes in.

This gamble has paid off before. In the early days of Tesla and SpaceX, Musk invested nearly all his personal wealth to keep the companies afloat. Both are now global leaders in their fields. His willingness to risk it all again shows that his belief in Tesla’s future is unwavering.

Looking Toward 2030 and Beyond

Where does this all lead? Musk has openly declared that by 2030, Tesla could be producing millions of robotaxis and generating more revenue from software than from hardware. If Tesla succeeds in creating a fleet of self-driving cars, the company’s valuation could dwarf that of any traditional automaker, making today’s billion-dollar buy look like a bargain.

At the same time, Tesla’s energy products could scale globally, turning the company into a cornerstone of the green revolution. Batteries, solar roofs, and energy storage systems could one day rival Tesla’s automotive division in importance. Musk’s investment, therefore, is not just about keeping Tesla alive — it’s about propelling it into a multi-industry empire.

Conclusion: The Billionaire Visionary’s Bet

Elon Musk’s decision to spend billions on Tesla shares is more than just a financial maneuver. It is a bold declaration of faith in the company’s mission and its future role in the world. By doubling down on Tesla, Musk is sending a message to investors, competitors, and the public: Tesla is here not just to compete but to dominate the self-driving era and beyond.

For some, this move is risky and reckless, given the uncertainty of markets and the immense technological challenges ahead. For others, it is classic Musk — daring, visionary, and confident that the future will bend in his direction. Either way, the billionaire’s gamble ensures that Tesla remains one of the most fascinating companies of our time, and its next decade promises to be nothing short of transformative.