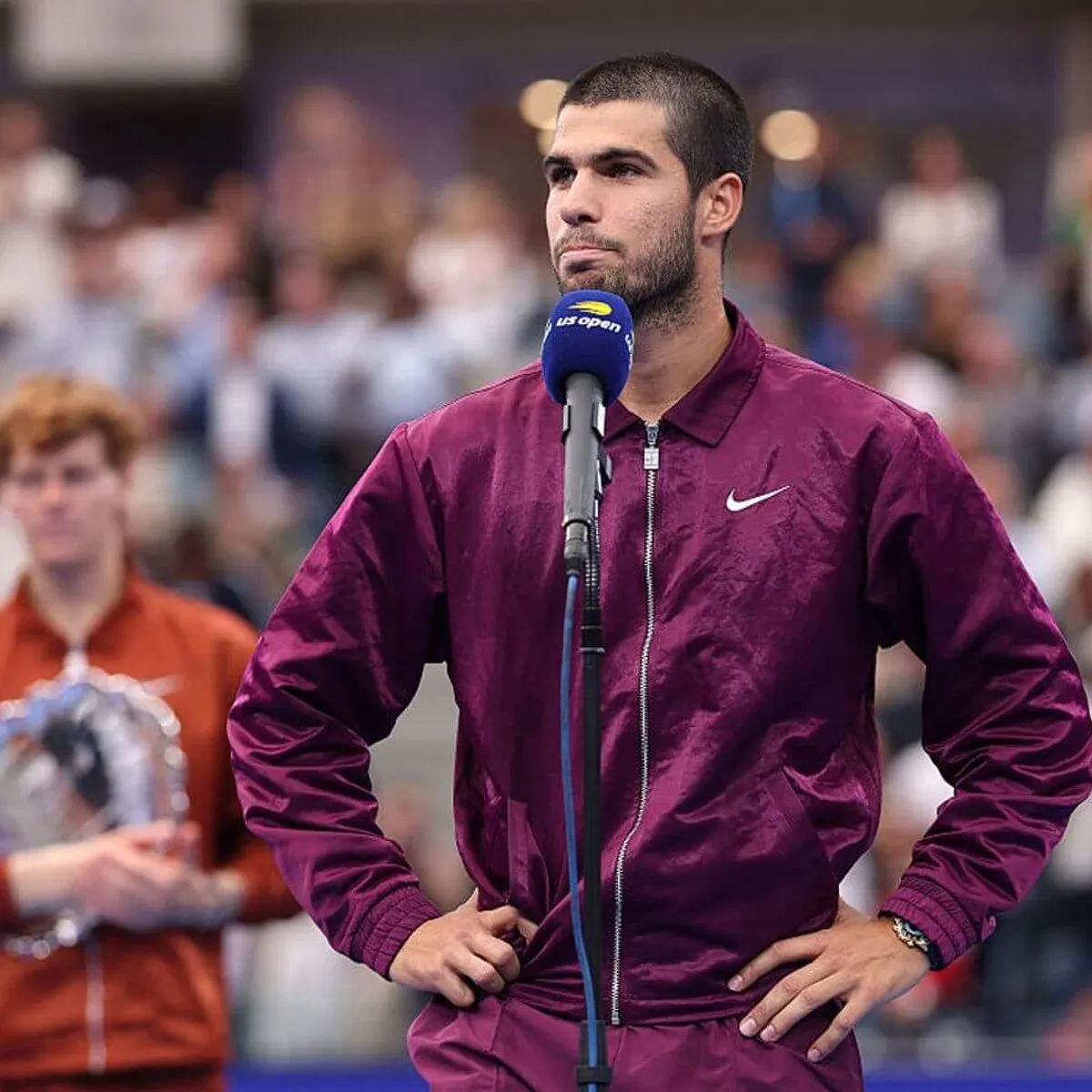

Carlos Alcaraz’s $5 Million US Open Jackpot Faces a Shocking Cut — Here’s the Twist No One Saw Coming

In the world of professional tennis, few names have risen as fast and as fiercely as Carlos Alcaraz. At just 21 years old, he has not only been hailed as the heir to the legacies of Rafael Nadal, Novak Djokovic, and Roger Federer, but he has also become the face of a new era where youthful exuberance collides with extraordinary talent. His victory at the US Open brought with it a staggering $5 million jackpot, the largest prize money ever awarded at the tournament.

Yet, while fans and analysts celebrated his triumph, a shocking twist has emerged that threatens to slash his winnings dramatically. This unexpected development has left both supporters and financial experts stunned, raising questions about the economics of tennis, endorsements, and the hidden pitfalls that even the most successful athletes face.

The Rise of a New Tennis Phenomenon

When Carlos Alcaraz stepped onto the courts of Flushing Meadows, few doubted his potential, but many wondered whether he could withstand the pressure of being a tournament favorite. From his explosive forehand to his ability to chase down balls that seemed destined to be winners, Alcaraz demonstrated why he is considered the future of the sport. His matches weren’t just victories; they were statements. Every serve, volley, and rally announced to the world that the torch was being passed.

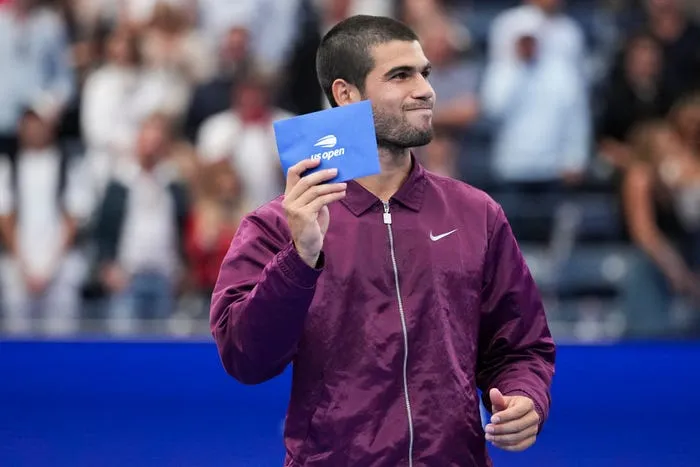

The culmination of his effort came in the form of a monumental win that secured not just a trophy but also that eye-watering $5 million prize check. For any player, such a figure is life-changing. For Alcaraz, it was supposed to be a symbol of a new chapter, marking his arrival at the very peak of the game. However, the celebrations did not last long before whispers of a financial storm began to swirl.

The Shocking Cut: Taxes and Hidden Deductions

While fans see the headline figure of $5 million, the reality of what a professional tennis player actually takes home is far more complicated. In the United States, where the US Open is held, winnings are subject to federal and state taxes that can swallow up nearly half the earnings. For Alcaraz, this means that before he even touches a single dollar, the government is entitled to a large share.

At a federal level, top earners are taxed at nearly 37%. Add to this the New York state tax, which can exceed 10%, and the amount shrinks drastically. What started as a historic $5 million jackpot could easily drop to around $2.5 million or less after taxes. For many fans, this revelation was shocking. To the casual observer, the idea that a superstar like Alcaraz could lose almost half of his winnings seems unfair, but it reflects the reality of competing and earning in one of the most heavily taxed states in the US.

Yet the story doesn’t end there. Additional deductions include payments to coaches, physiotherapists, agents, and trainers, all of whom play an integral role in an athlete’s success. Industry insiders estimate that nearly 10–15% of a player’s earnings can be consumed by these professional costs. That means the true net figure that lands in Carlos Alcaraz’s pocket may be closer to $2 million than the headline-grabbing $5 million.

The Twist: International Tax Complications

If the harsh American tax system wasn’t enough, there is yet another twist that most fans rarely consider: international taxation. As a Spanish citizen, Alcaraz is subject to Spain’s global income tax laws. Spain, known for having some of the highest personal tax rates in Europe, can claim an additional portion of his earnings, even those made abroad. This creates a tangled web of cross-border tax negotiations, exemptions, and double-taxation treaties that can sometimes leave athletes bewildered and financially strained.

For Alcaraz, the implication is clear — while the US Open jackpot was marketed as a record-breaking payday, the sum he will ultimately enjoy may be drastically smaller. This revelation has sparked debates across the tennis community about whether prize money figures should be advertised differently, accounting for the massive deductions that inevitably follow.

Sponsorships: The Real Jackpot Behind the Scenes

Despite the tax complications, it’s important to recognize that Carlos Alcaraz is not solely reliant on prize money. In fact, for most top athletes, endorsements and sponsorship deals far outweigh their tournament earnings. Brands like Nike, Rolex, and Babolat have already aligned themselves with the young Spaniard, and his marketability skyrocketed following his Grand Slam victories.

Industry estimates suggest that Alcaraz could earn upwards of $15–20 million annually from sponsorships alone. These deals are structured differently from prize money, often with more favorable tax treatments depending on how contracts are negotiated. Moreover, they provide long-term stability, ensuring that even if a bad season on the court cuts into prize earnings, his financial security remains intact.

Here lies the real twist: while his $5 million US Open jackpot faces a shocking cut, the victory itself is a catalyst for much larger financial opportunities. Every match he wins, every trophy he lifts, cements his value in the eyes of global corporations eager to attach their brand to his rising stardom.

The Broader Issue: Tennis Economics Under Scrutiny

The drama surrounding Alcaraz’s jackpot cut highlights a broader issue within professional tennis — the disparity between headline prize figures and actual take-home pay. While the top stars earn millions, lower-ranked players often struggle just to cover travel expenses, coaching fees, and basic living costs. The gap between the haves and have-nots in tennis is stark, and Alcaraz’s situation, though at the highest level, underscores how misleading the financial narrative can be.

Fans often question why so much of the prize money disappears into taxes and deductions, but governments argue that high earners should contribute their fair share. Meanwhile, critics suggest that tournaments should advertise net figures rather than gross, providing a clearer picture to fans and players alike.

Public Reactions: Shock, Debate, and Support

When news of Alcaraz’s reduced earnings spread, social media platforms erupted with reactions. Many fans expressed outrage, arguing that athletes who dedicate their lives to their craft should be able to keep more of their hard-earned money. Others pointed out that even after deductions, earning millions from a single tournament is still an extraordinary privilege.

Interestingly, Alcaraz himself has remained composed. Known for his maturity beyond his years, he has not publicly complained about the situation. Instead, he has emphasized his gratitude for the opportunities tennis has provided him, while acknowledging the team effort behind his success. This humility has only endeared him further to fans worldwide, strengthening his image as not just a champion on the court, but a role model off it.

What This Means for the Future of Tennis Stars

The case of Carlos Alcaraz’s $5 million jackpot serves as a cautionary tale for future stars rising through the ranks. Financial advisors are increasingly emphasizing the importance of smart money management, investment strategies, and tax planning for athletes. The days when a player could simply rely on prize money alone are long gone. Today’s champions must navigate a global financial maze that is every bit as challenging as their opponents on the court.

For Alcaraz, the future remains incredibly bright. With youth on his side, a growing fan base, and endorsements pouring in, he is well-positioned to not only dominate the tennis landscape but also to secure long-term financial success. The initial shock of his US Open jackpot cut may sting, but it is unlikely to derail his meteoric rise.

Conclusion: The Twist No One Saw Coming

At first glance, the headline “Carlos Alcaraz wins $5 million at the US Open” seemed like the perfect fairy-tale ending to a breakthrough tournament. But beneath the surface lies a far more complex reality — one where taxes, international laws, and professional costs chip away at the figure until only a fraction remains. This is the shocking twist that few fans anticipated, and it shines a spotlight on the hidden side of professional sports.

Yet, in many ways, this twist does not diminish Alcaraz’s achievement. Instead, it adds depth to the story of a young champion navigating both the triumphs and the challenges that come with global stardom. His victory at Flushing Meadows was more than just about prize money — it was a statement that a new era of tennis has arrived, led by a player whose resilience and talent promise to shape the sport for years to come.

In the end, while the $5 million jackpot may face a shocking cut, the real jackpot for Carlos Alcaraz lies in his enduring potential, his growing influence, and his undeniable place in the future of tennis.