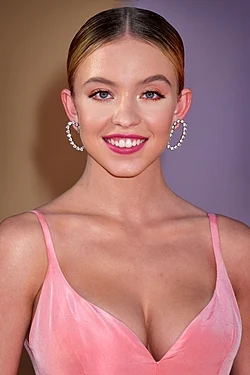

Sydney Sweeney’s $310 Jeans Ad Sends Stocks Skyrocketing — But BofA Says You Should Sell Now for This One Reason

American Eagle is no stranger to reinvention, but even its most high-profile marketing efforts may not be enough to turn the tide. Its recent denim campaign featuring actress Sydney Sweeney made significant noise on social media, drawing attention from fans and investors alike. The campaign sparked excitement, even pushing the company into the meme stock spotlight. However, Bank of America (BofA) analysts remain skeptical, issuing a stark downgrade and citing larger structural challenges—chief among them: tariff impacts, limited pricing power, and constrained operational flexibility.

Sydney Sweeney’s Campaign: A Viral Moment for American Eagle

In July, American Eagle launched a bold new campaign promoting its iconic jeans collection, this time fronted by rising Hollywood star Sydney Sweeney. Known for her roles in popular shows and films, Sweeney brought fresh energy to the brand, helping it trend on platforms like TikTok and Instagram. Her image, often styled in classic denim looks, resonated with both Gen Z and millennial shoppers.

The campaign was creative and undeniably effective from a marketing standpoint. Its tagline, a cheeky play on “great genes,” tapped into Sweeney’s real-world popularity and fashion credibility. As a result, American Eagle’s stock surged as much as 33% in the days following the launch—a clear sign that the market responded positively, at least initially.

But this uptick was short-lived.

Bank of America Downgrades Stock to ‘Underperform’

Despite the viral success of the campaign, BofA analysts cut their rating on American Eagle stock to “underperform,” the equivalent of a sell recommendation. They also lowered the price target to $10, approximately 21% below where shares were trading at the time of the announcement.

According to BofA, the challenges facing American Eagle run deeper than brand awareness or marketing buzz. The report emphasized that the company is heavily exposed to tariffs, which are expected to cut gross profits by an estimated $40 million this fiscal year. While American Eagle has taken steps to reduce operating costs in recent years, BofA analysts noted that “the low-hanging fruit has been accomplished,” suggesting there’s little more the brand can do in terms of easy cost-cutting.

Tariffs: The Real Threat to Profit Margins

While celebrity endorsements can elevate brand visibility, they can’t erase the hard math behind rising import taxes. American Eagle’s reliance on international manufacturing leaves it vulnerable to tariffs, especially those affecting textiles and apparel.

Tariffs are expected to directly impact the company’s gross margins, reducing its overall profitability despite a loyal customer base. Even worse, American Eagle reportedly has limited pricing power, meaning it cannot easily pass these increased costs onto customers without risking a drop in sales.

This presents a fundamental challenge. If the brand cannot offset the rising costs through either higher prices or operational efficiency, profitability will continue to decline—regardless of marketing campaigns.

Marketing vs. Long-Term Performance

BofA analysts expressed doubt that Sydney Sweeney’s campaign could drive long-term gains. They acknowledged its success in generating short-term attention but questioned its ability to produce lasting change in American Eagle’s financial trajectory.

According to the report, marketing spend remains below industry peers, which limits the campaign’s reach and longevity. BofA added, “We do not assign a high likelihood that momentum from this campaign can fully inflect the business over the long run.”

In other words, while Sweeney may have brought a temporary spike in consumer interest, the deeper issues—such as supply chain dependencies, cost structures, and competition—require more systemic solutions.

The Meme Stock Phenomenon: A Double-Edged Sword

The Sydney Sweeney campaign unintentionally launched American Eagle into meme stock territory, with retail traders jumping in on the excitement. The stock price saw unusual volatility in July, mirroring the behavior seen in other companies that have become the subject of internet-driven investment frenzies.

While this exposure may have helped boost share volume and created headlines, meme stock momentum rarely leads to sustainable growth. More often, it introduces unpredictable volatility that can be risky for both the company and its investors. For American Eagle, the spike was not backed by fundamental improvements in financial performance, making it a short-lived victory.

The Bigger Problem: Aerie and Declining Margins

American Eagle’s challenges extend beyond its namesake brand. Aerie, the company’s activewear and intimates division, has also struggled to maintain momentum. Once considered a growth driver, Aerie is now facing category-wide headwinds—including saturation, reduced consumer demand, and fierce competition.

Bank of America expressed concern that Aerie no longer holds a significant competitive advantage, and any reduction in performance here further weighs down overall profitability.

Additionally, marketing investments for Aerie have been comparatively lower, reducing the brand’s ability to compete in a highly visual and influencer-driven segment. The end result? Slower growth, tighter margins, and increasing pressure on American Eagle to deliver results through its denim business—hence the urgency of the Sydney Sweeney campaign.

Operational Constraints Limit Strategic Options

BofA’s analysis highlights another sobering fact: American Eagle has limited levers left to pull. In recent years, the company has already taken steps to reduce overhead and streamline operations. But with most of the easy gains already realized, future cost reductions may come at the expense of quality or customer experience.

Furthermore, the company’s marketing budget lags behind competitors, meaning it can’t sustain the kind of multi-channel, long-term brand storytelling required to turn viral campaigns into revenue drivers.

Compounding this issue is the broader retail environment. With inflation, consumer spending cuts, and rising logistics costs, American Eagle is operating in an increasingly difficult landscape—one where short-term celebrity campaigns simply aren’t enough to guarantee survival.

Is There a Way Forward?

While the immediate outlook remains cautious, American Eagle is not without opportunities. The brand still holds significant recognition, especially among younger shoppers. Its focus on denim, a timeless wardrobe staple, gives it an edge in terms of relevance and utility.

However, reviving the company’s financial strength will require more than a viral moment. Strategic investments in supply chain diversification, better inventory management, and enhanced digital experiences could help offset external pressures. Likewise, a refreshed approach to pricing and promotion may be necessary to regain margin stability.

Moreover, if American Eagle wants to continue leveraging cultural figures like Sydney Sweeney, it will need to support those campaigns with consistent product innovation, expanded marketing efforts, and measurable ROI.

Conclusion: Style Isn’t Enough to Save the Bottom Line

The Sydney Sweeney American Eagle campaign proved the brand still has cultural relevance. The campaign was clever, visually compelling, and momentarily successful in drawing attention and engagement. But according to Bank of America, the structural issues facing American Eagle—namely tariffs, low pricing power, and limited strategic flexibility—are too great to overcome with marketing alone.

In a competitive and volatile retail environment, celebrity-driven campaigns are a valuable tool—but not a solution. Long-term success depends on strong fundamentals, operational agility, and the ability to adapt to macroeconomic shifts. For American Eagle, those are the real challenges that lie ahead.