Jeff Bezos Secrets Exposed From Early Amazon Stock Moves

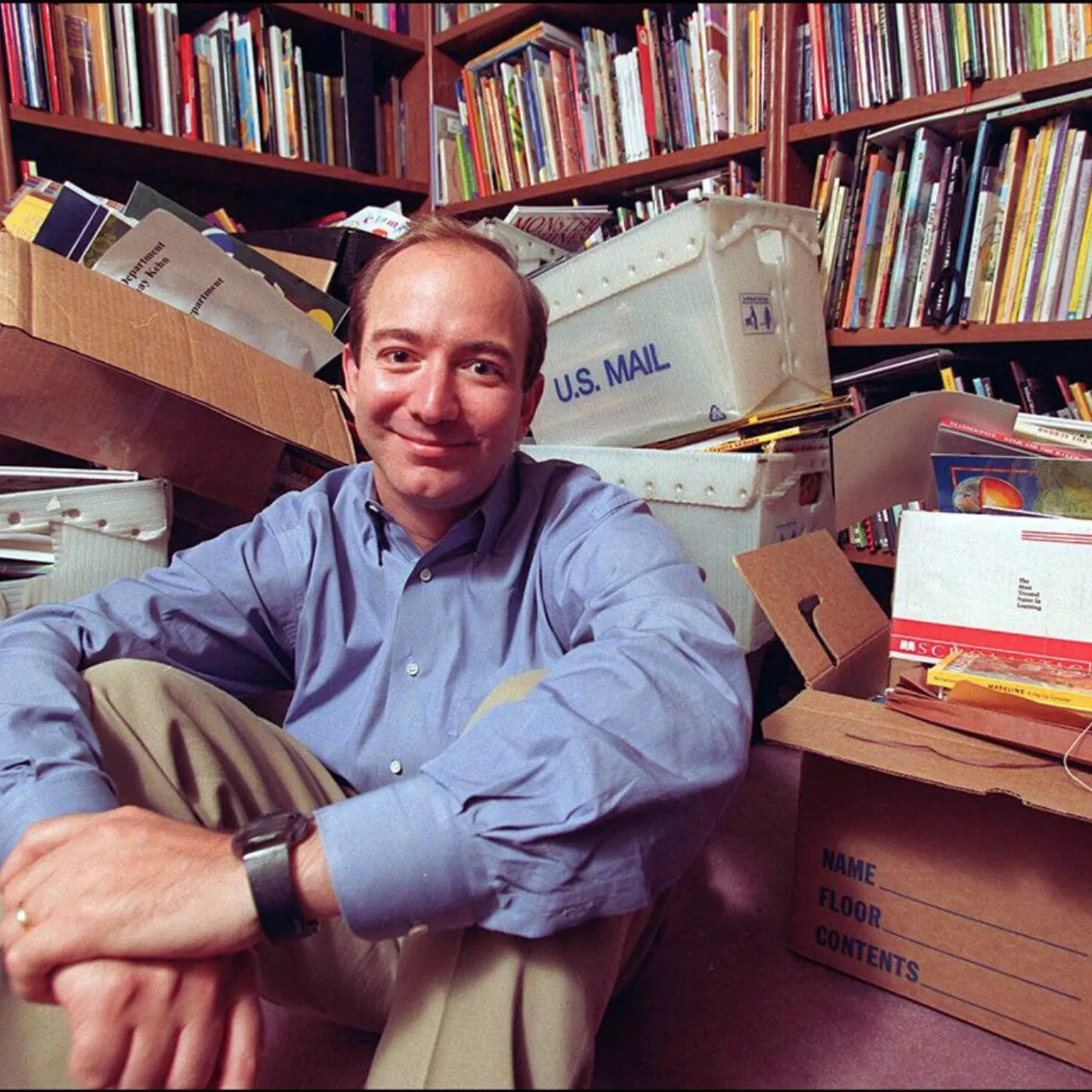

In the world of business legends, few names carry the weight and controversy of Jeff Bezos. From a small garage in Seattle to becoming the titan behind Amazon, Bezos’ journey is the blueprint for bold moves, high stakes, and sometimes, ruthless decisions. Yet, while the headlines often highlight his latest ventures or personal life, a closer look at Jeff Bezos’ early Amazon stock sales reveals insights that can transform how investors and entrepreneurs approach wealth. These lessons are not just about money—they’re about strategy, timing, and human psychology.

Lesson 1 Bold Moves Define Long-Term Success

One of the most shocking aspects of Bezos’ early stock transactions is how unapologetically bold they were. At a time when many would hesitate, fearing market volatility or public scrutiny, Bezos made decisions that defied conventional financial wisdom. He understood that fortune favors the bold, and his early willingness to leverage Amazon shares set a precedent for long-term dominance.

For everyday investors, the takeaway is clear: hesitation can be costly. Watching the market from the sidelines may feel safe, but those who wait for perfect conditions often miss the window of opportunity. Bezos’ early maneuvers demonstrate that calculated risks, supported by data and vision, can yield unprecedented rewards.

Lesson 2 Timing Is Everything

The timing of Jeff Bezos’ stock sales is almost surgical. He didn’t just sell shares; he executed a strategy. Selling too early could have stunted growth potential, while waiting too long might have exposed him to market downturns. The lesson is simple yet powerful: understanding when to act is as important as knowing what action to take.

In a world where investors obsess over numbers and trends, many overlook the subtle art of timing. Bezos’ decisions highlight the importance of reading market signals, company performance, and broader economic conditions. Timing isn’t about luck—it’s about preparation and strategic foresight.

Lesson 3 Psychological Discipline Beats Impulse

Another hidden lesson in Bezos’ early Amazon stock sales is the psychological discipline required to execute them. It’s one thing to recognize a financial opportunity, but it’s another to act with restraint, ignoring hype, noise, and external pressures. Bezos demonstrated a mastery of emotional intelligence, choosing moves that aligned with long-term objectives rather than short-term validation.

For those navigating the stock market or launching startups, this is a crucial takeaway. Impulsive decisions often lead to missed opportunities or catastrophic losses. Learning to separate emotion from strategy, as Bezos did, can transform average investors into market leaders.

Lesson 4 Every Move Sends a Signal

Every sale of stock, every investment choice, and every public announcement from Bezos carried a hidden message to competitors, investors, and the market. His early stock moves weren’t just financial decisions—they were strategic communications. By subtly signaling confidence, restraint, or opportunity, Bezos shaped perception while advancing his own goals.

This lesson goes beyond investing. In any high-stakes environment, whether in entrepreneurship, corporate leadership, or content creation, every action can influence public perception. Bezos’ approach reminds us that strategy isn’t just about what you do—it’s about how it’s perceived.

The Bigger Picture of Bezos’ Early Strategies

Analyzing Jeff Bezos’ early Amazon stock sales reveals more than just financial genius. It uncovers a mindset that blends calculated risk, market acumen, psychological discipline, and strategic signaling. These are qualities that extend beyond the boardroom, impacting how we approach challenges, assess opportunities, and make decisions in any competitive field.

While critics might argue that not everyone can replicate Bezos’ fortune, the core lessons are universally applicable. They emphasize the value of vision over caution, strategy over impulse, and perception over reaction. For entrepreneurs, investors, or anyone with ambition, these insights offer a roadmap to navigate uncertainty with confidence.

Controversy Surrounding Bezos’ Early Moves

No discussion of Jeff Bezos’ stock strategy would be complete without acknowledging the controversy it stirred. Early sales, often perceived as secretive or aggressive, drew criticism from pundits who claimed he prioritized personal gain over shareholder interests. Yet, history proves that these moves propelled Amazon from a fledgling bookstore to a global empire, validating Bezos’ long-term thinking.

The lesson here is double-edged: bold moves invite scrutiny, but smart, calculated decisions create undeniable results. For readers navigating the modern digital economy, this underscores the tension between short-term perception and long-term payoff.

Implications for Modern Investors

In today’s volatile financial landscape, Bezos’ early strategies hold timeless relevance. From cryptocurrency investors to startup founders, the same principles apply: boldness, timing, discipline, and strategic signaling. Those who internalize these lessons are better positioned to navigate uncertainty, capitalize on emerging trends, and build sustainable wealth.

Moreover, the psychological angle cannot be overstated. Markets are influenced by emotion, hype, and herd mentality. Understanding how a visionary like Bezos manages both his assets and perception provides an invaluable lesson for anyone seeking a competitive edge.

Why These Lessons Matter Today

As tech giants dominate headlines and startups chase rapid growth, many fail to study the foundational strategies of industry leaders. Bezos’ early Amazon stock sales weren’t just financial maneuvers—they were case studies in strategic thinking, resilience, and market psychology.

For those ready to challenge conventional wisdom, these lessons provide a blueprint. They encourage risk-taking where appropriate, reinforce the importance of timing, stress emotional discipline, and highlight the power of signaling. In short, they offer a playbook for anyone who wants to think like a billionaire without blindly imitating them.

Conclusion: Transforming Insight into Action

The story of Jeff Bezos and his early Amazon stock sales is more than historical curiosity. It’s a source of actionable insight for modern investors, entrepreneurs, and ambitious professionals. By studying his moves, we gain understanding of how strategic foresight, boldness, psychological control, and messaging intersect to create extraordinary outcomes.

Ultimately, the four lessons—bold moves, perfect timing, psychological discipline, and strategic signaling—aren’t just financial tactics. They’re principles that can transform careers, investments, and approaches to life itself. Bezos’ journey reminds us that while not every investor can replicate his wealth, anyone can adopt his mindset, study his strategies, and apply these lessons to turn calculated risks into remarkable success.

Whether you’re navigating stocks, startups, or any competitive environment, these insights provide a framework to think bigger, act smarter, and anticipate outcomes with precision. The controversy, the boldness, and the genius of Jeff Bezos’ early Amazon stock sales aren’t just history—they’re a roadmap for the next generation of visionaries willing to challenge the status quo.