Elon Musk’s Wild Robotaxi Promise Leaves Tesla Investors Reeling

Tesla has always thrived on big promises. From the first Roadster that flipped the script on electric cars to the Model S that turned speed demons green, Elon Musk has built his empire on bravado as much as batteries. But in 2025, the line between visionary and overpromiser is looking razor thin.

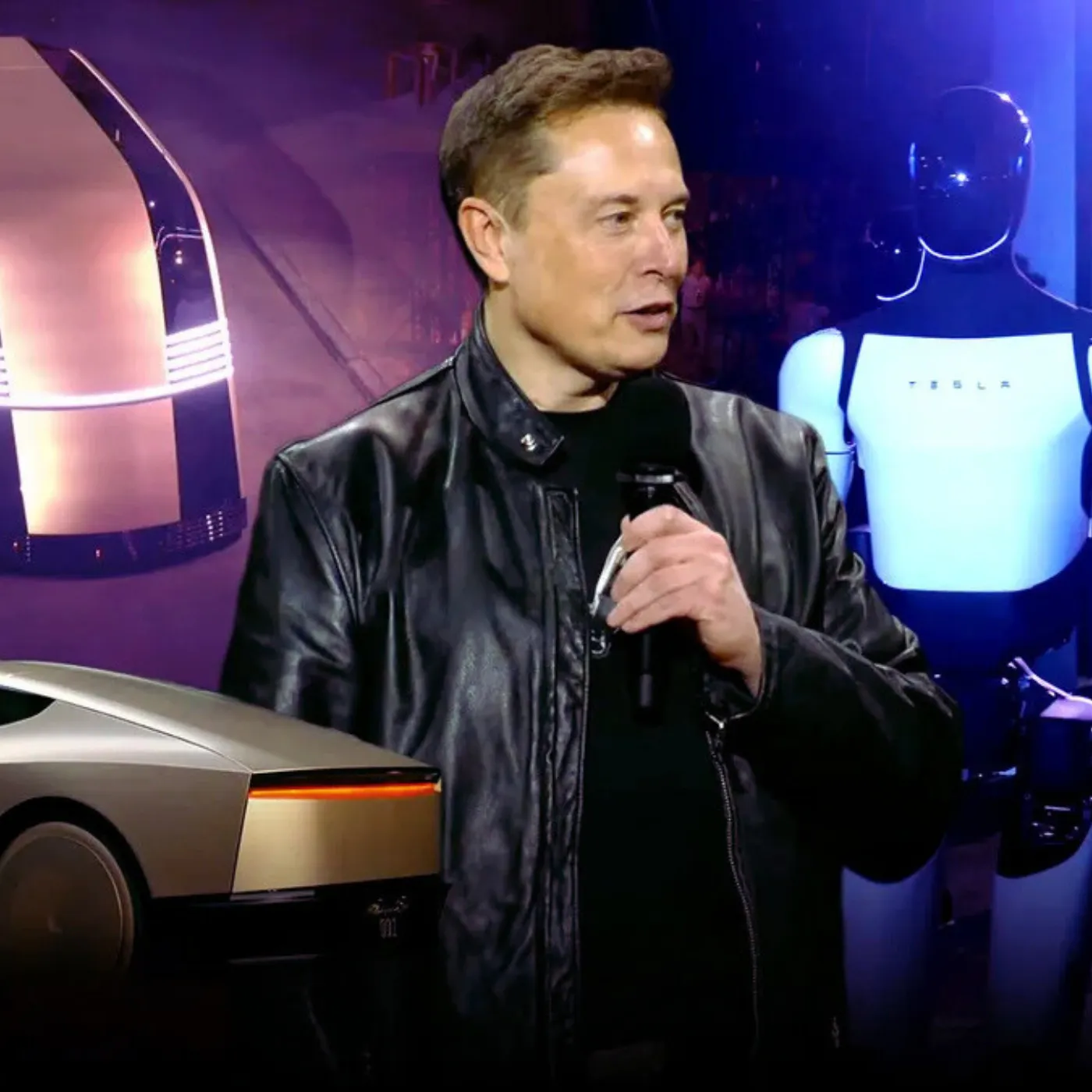

For months, Musk hyped June as the moment Tesla would finally deliver on its long-awaited Robotaxi dreams. The pitch was classic Musk: fully self-driving, no human intervention, a new era in urban mobility. He hinted it would transform cities, redefine transport economics, and even threaten Uber’s very existence.

Investors, ever hungry for the next “AI-powered disruption,” piled in. Tesla’s stock rallied in anticipation. Analysts talked breathlessly about trillion-dollar addressable markets. Social media meme accounts that worship at the altar of Musk turned “Robotaxi” into a rallying cry.

And then June came.

And went.

No Robotaxi.

Not in Los Angeles. Not in San Francisco. Not even in the controlled environments Tesla fans insisted would prove the concept. Instead, what shareholders got was a perfect storm of angry earnings calls, downgrades, and questions that Musk—despite his usual X-post swagger—hasn’t convincingly answered.

The Promise That Broke the Spell

It’s not that Musk didn’t warn people about the difficulty of autonomy. For years he’s said, “Solving autonomy is hard,” and claimed Tesla was “months away” from cracking it. But his own words about June 2025 left little wiggle room: “This is the year we deliver real robotaxis.”

He doubled down in interviews. He posted cryptic memes suggesting that Tesla’s competitors would be blindsided. He even teased a massive reveal event.

So investors believed him.

That’s the Musk effect in a nutshell. He’s not just a CEO; he’s a meme in human form, with an army of retail investors who treat him like a prophet. When he says jump, they ask how high—and when he says buy, they click “market order.”

But markets don’t run on hype alone. June’s no-show exposed the difference between aspirational storytelling and operational reality.

The Backlash Is Brutal

Tesla’s stock lost billions in market cap within days of the missed Robotaxi hype peak. Analysts started slashing price targets. Some of Musk’s most loyal retail investors posted angry videos about being misled.

On Facebook, X, and Reddit, the tone shifted from “in Musk we trust” to “he lied to us.”

The biggest complaint wasn’t that the technology wasn’t ready—most serious investors knew L5 autonomy is years away. It was that Musk made it sound like it was here.

Words like “betrayal,” “snake oil,” and “scam” began trending in comment sections that, only weeks earlier, looked like cult gatherings.

Some Musk defenders say the backlash is overblown, blaming short sellers or media bias. But the data is hard to ignore. Retail investors who jumped in around the peak of the hype lost big.

Robotaxi Technology Proves Tricky

Why didn’t Tesla deliver? The technical barriers are enormous.

Despite enormous progress in AI, computer vision, and neural networks, true driverless navigation is a nightmare. Urban environments are chaotic, laws differ by state, and even Tesla’s best Full Self-Driving Beta still requires human oversight.

Other companies trying to crack the code—like Waymo or Cruise—run limited services in heavily mapped zones, with tons of remote monitoring. Even they have faced embarrassing incidents that went viral.

Musk’s vision wasn’t just about matching them. He wanted to leapfrog them.

He sold the idea of a Tesla Robotaxi fleet anyone could summon with an app, with existing owners able to send their cars out to work while they slept. It was a “future of work” pitch, a “passive income” dream, a tech-bro fever fantasy.

But the hardware wasn’t there. The software wasn’t there. The regulatory approvals definitely weren’t there.

And in June 2025, that all became clear.

The Investor Meltdown

For people who took Musk at face value, the failure to deliver wasn’t just disappointing. It was financially devastating.

Tesla’s stock tumbled. Margin calls triggered for some retail traders. Options buyers were wiped out.

Many posted screenshots of their losses on social media, calling Musk a fraud, a liar, and a salesman who hyped his own stock price at their expense.

Memes flipped from worship to mockery.

One popular viral post showed a Tesla with “Robotaxi” scrawled on the side, being towed away after a crash test. The caption?

“Not exactly autonomous.”

It’s the sort of brand damage that lingers.

Tesla’s Official Response: Spin or Strategy?

Tesla’s communications team tried to spin the flop.

They talked about “ongoing development,” “incredible progress,” and the need to “prioritize safety.”

Musk himself went on X to post cryptic jokes about “beta features” and “waiting for regulators,” trying to keep the vibe playful, even as people lost real money.

But the jokes didn’t land this time.

Even some Tesla bulls admitted the hype got away from him.

The Cult of Elon Musk: Cracking at the Edges?

For years, Musk has enjoyed a nearly bulletproof relationship with his most loyal fans and investors. He could insult analysts on earnings calls, call people “pedos” online, and move markets with a single emoji.

But the Robotaxi meltdown feels different.

It wasn’t about a single tweet. It was about months of promises, aggressive timelines, and an entire marketing push built around June as a magical month.

When June didn’t deliver, even true believers felt burned.

Will they come back? Probably. Musk’s brand is resilient. He’s still the guy who sent a car to space, landed rockets, and built the most successful EV brand on Earth.

But cracks are showing.

Industry Analysts Say, “We Told You So”

Critics of Tesla’s autonomous claims have been warning for years.

Waymo’s CEO once said Tesla was “irresponsible” for suggesting autonomy was near.

Former Apple execs said Musk was overhyping the problem space.

Regulators were worried about public safety.

Musk dismissed them as haters.

But the June Robotaxi miss has validated those warnings.

What Happens Next?

Investors will demand clearer timelines.

Regulators may increase scrutiny of Tesla’s Autopilot and Full Self-Driving marketing.

Competitors will seize the moment to point out Tesla’s overpromising.

Consumers might think twice about paying thousands for “Full Self-Driving” features that remain in beta.

And Musk?

He’ll probably tweet through it.

The Bigger Picture: Elon’s Brand of Hype

This isn’t the first time Musk has overpromised.

Remember “1 million robotaxis by 2020”?

Or “Cybertruck deliveries in 2021”?

Or “Mars by 2024”?

Musk’s entire playbook is to sell the dream, rally retail investors, and fuel demand while buying time to actually deliver.

It’s worked incredibly well.

But the Robotaxi meltdown might signal that the spell is breaking—at least a little.

Final Thoughts: Tesla Isn’t Dead, But the Hype Might Be

No one’s writing Tesla’s obituary.

It’s still the most valuable car company on Earth. It still sells more EVs than anyone else. Musk is still a singular figure in tech and pop culture.

But the Robotaxi failure feels like a turning point.

It’s a reminder that even the most hyped technology has limits. That even the richest man in the world can’t will fully autonomous cars into existence overnight.

It’s a lesson for investors about the cost of buying the dream without checking the receipts.

And for Musk, it’s a warning: in an age of infinite receipts, even the best storytellers can’t outrun the truth forever.